As tax season begins to wind down, you're likely breathing a sigh of relief, with your financial documents and receipts soon to be stowed away until next year. Before you tuck those files away, consider this: the very best time to craft your tax savings plan is actually right now.

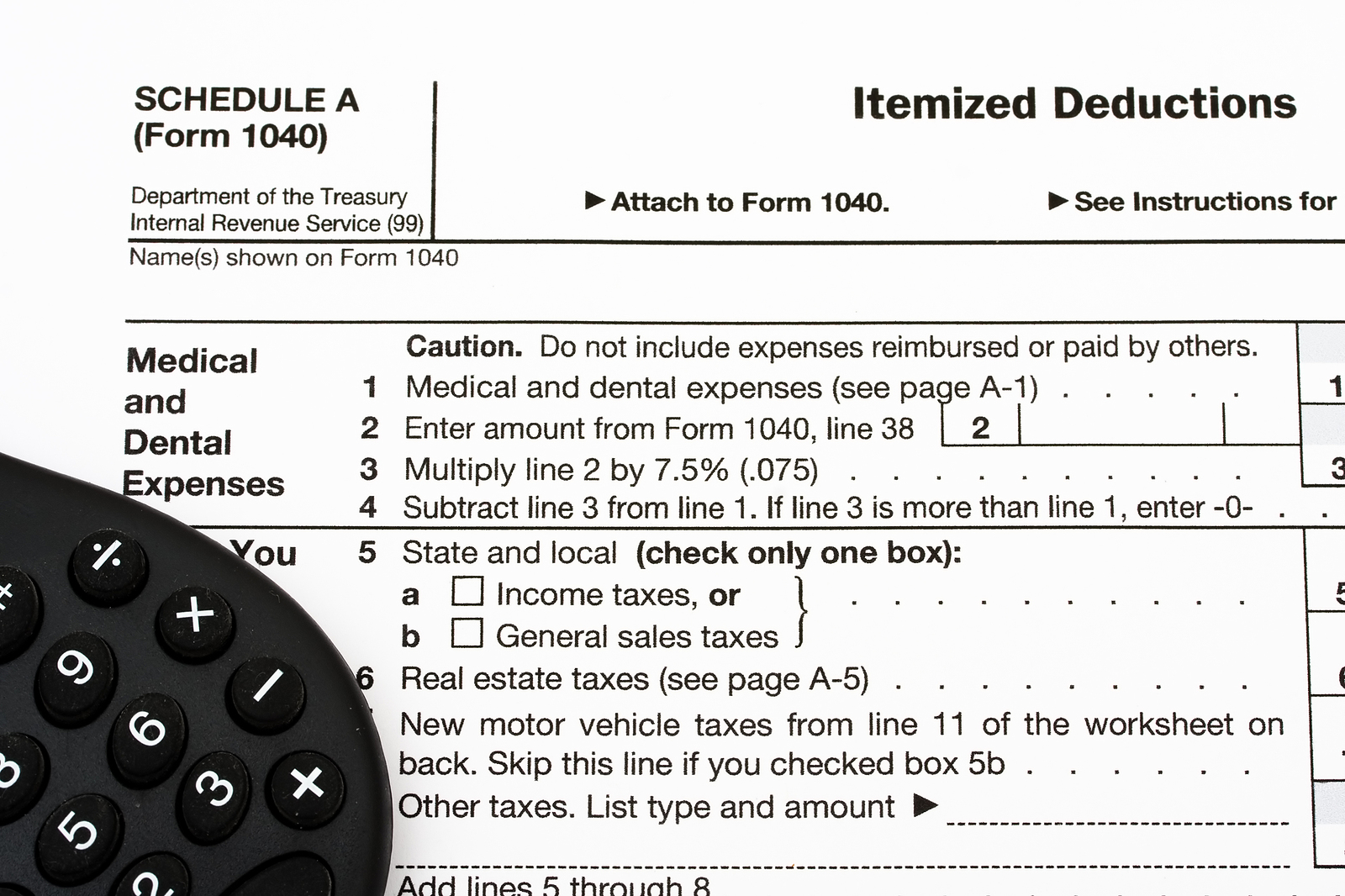

It's tax time again, which often means a flurry of activity, a blizzard of paperwork, and an avalanche of mixed information. Arguably, one of the most important decisions you'll face this tax season is whether to take the standard deduction or itemize your deductions. This seemingly minor decision can have a massive impact on the complexity of your filing process but can still be the best choice in many situations. Explore the world of itemized deductions to equip yourself with the knowledge you need to make an informed decision tailored to your unique tax situation.

Though it’s common knowledge that taxes are one of life's few certainties, taxes can certainly feel complicated and confusing at times. For some filers, tax season is a stressful scramble for receipts, forms, and information. For others, the season brings the welcome news of a tax refund - a nice chunk of change heading back into your pocket when the process concludes for the year. Still, the path your tax refund takes from the time you file to when you actually receive your money can feel like it's shrouded in mystery. What factors affect how long it takes to arrive? And, once it does, what are some of the wisest ways to put your windfall to use?

Facing an IRS audit or dealing with a complex tax issue can feel a bit like navigating an endless, highly complicated maze. While the IRS does provide resources and information, the process can be incredibly overwhelming, leaving you feeling unsure and out of your depth. In these situations, understanding your options and seeking professional support becomes crucial. This is where third-party representation comes in, offering a valuable solution to individuals and businesses facing tax challenges.

Winter weather may still be hanging around, but for financially-minded folks, a different kind of chill is in the air – tax season is upon us! While April 15th might feel like a distant date on the horizon, it's approaching rapidly. This begs the question: early-bird filing or a last-minute scramble? There is no magical, one-size-fits-all answer; it all boils down to your unique financial situation and goals.

While many routines in life remain consistent, the tax code isn't one of them. Every year brings adjustments, and 2023 is no exception to that rule. Several vital changes, driven by inflation, have impacted everything from tax brackets to retirement contributions, but don’t fret - some of the changes might even be beneficial. Read through to get a clear breakdown of what's new, and the ways in which it will (or will not) affect your tax status this year. If you need expert tax advice or clarification on any of these adjustments, arrange a meeting with your CPA or other professional tax preparer.

Tax season often brings with it a sense of profound dread, a towering pile of paperwork, and the nagging fear you may have overlooked essential deductions. What if this year could be different, though? If you keep well-systemized records (paper and digital) from the start of the year, you can avoid the unnecessary chaos of disorganized and incomplete files at tax time. The secret of transforming tax preparation into a manageable task? Great recordkeeping!

Navigating Social Security claiming options can sometimes feel like traversing a complex financial labyrinth. While uncertainties may arise, understanding the key milestones and their implications empowers you to plot your retirement course confidently. Let us shed some light on the claiming landscape, dispel a few common myths, and review some factors that can help you to make informed decisions for a financially secure future.

As we approach the end of the year, we want to extend warm wishes to you and your loved ones. The team at Myrick CPA hopes this finds you in good spirits, anticipating the fresh opportunities and successes the New Year will bring.

As the end of the year approaches, and the trajectory of our lives seems to speed up towards the holidays, it’s a good idea to take a moment and consider your financial situation. Getting your finances in order before the year ends can provide peace of mind, positioning you for a smooth segue into the new year. Whether you want to pay off debt, save more for retirement, or simply create an updated budget to help achieve your financial goals, now is an ideal time to take action.