Crowdfunding has become a popular way to raise funds for everything from new business ventures to charitable causes. Platforms like Kickstarter and GoFundMe make it easy to reach a wide audience and gather financial support, but if you’re organizing a crowdfunding campaign, it’s essential to understand the tax obligations that come with those contributions. In some cases, money raised through these platforms may be subject to income tax, requiring careful record keeping and reporting.

Facing tax issues with the IRS can feel overwhelming, especially if you’re dealing with a tax lien or levy. These actions are serious, and understanding what the IRS can and cannot do is critical to protecting your assets and resolving the problem quickly. The good news? With the help of a qualified CPA, you can take steps to address the situation and get back on solid financial ground.

The IRS recently adjusted Health Savings Accounts (HSA) rules for 2025. If you've been using an HSA as part of your financial plan, now is a great time to revisit your strategy to ensure it's still working as well as possible. Understanding these new changes is a vital part of making sure you're maximizing your tax savings and the benefits of your HSA.

Getting a big tax refund might feel like a financial win, but there’s another side to the story. While it’s nice to receive a check from the IRS, that money was yours all along. In essence, you’ve been giving the government an interest-free loan. Let’s take a closer look at tax refunds and how you can keep more of your money throughout the year.

When it comes to managing your taxes, understanding the difference between tax preparation and tax planning can have a major impact on your overall financial health. While both services are vital, they serve different purposes and offer unique benefits. Finding out what sets them apart, and why hiring a CPA to help you with both prep and planning can be a game-changer for your finances.

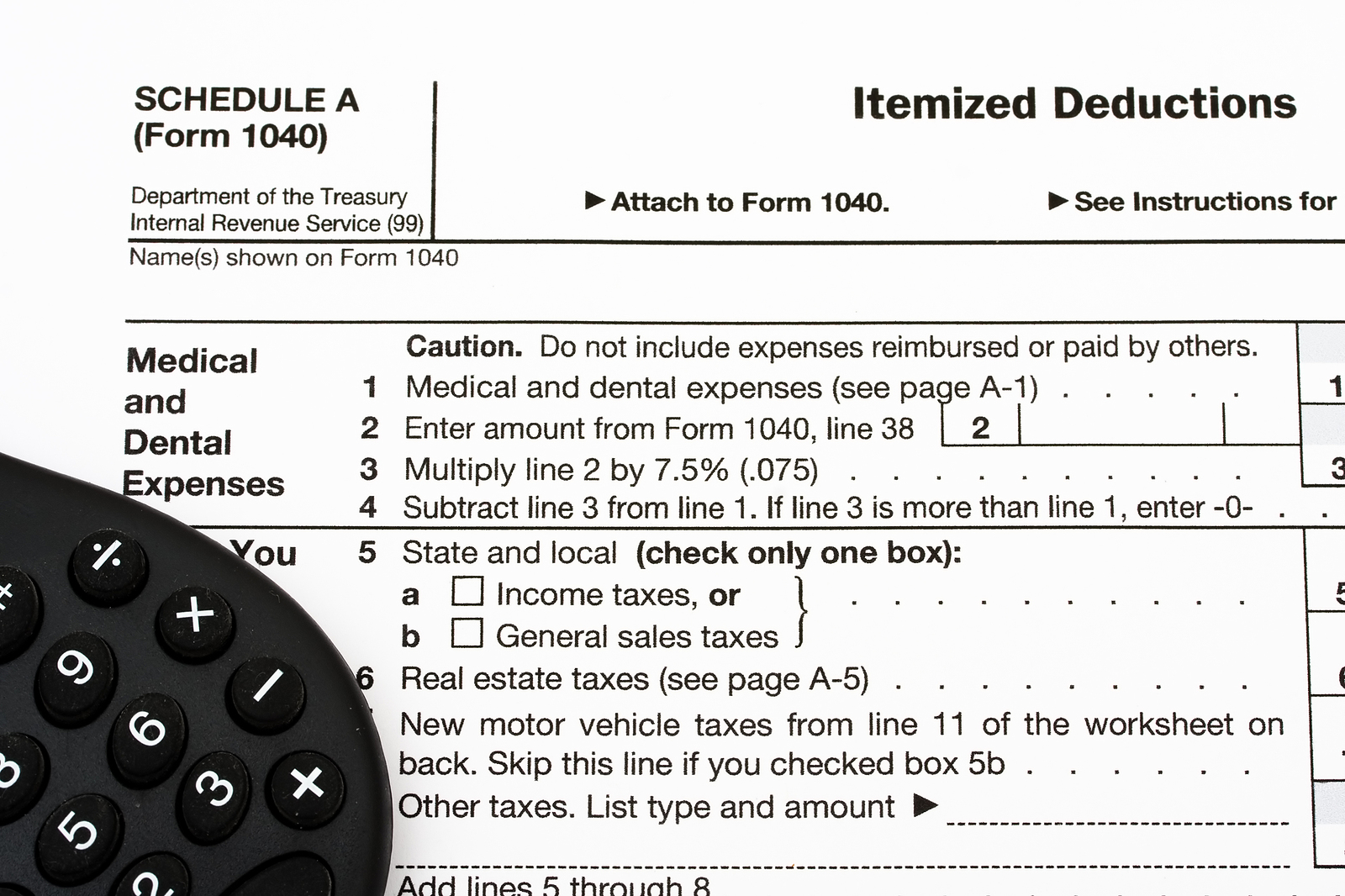

It's tax time again, which often means a flurry of activity, a blizzard of paperwork, and an avalanche of mixed information. Arguably, one of the most important decisions you'll face this tax season is whether to take the standard deduction or itemize your deductions. This seemingly minor decision can have a massive impact on the complexity of your filing process but can still be the best choice in many situations. Explore the world of itemized deductions to equip yourself with the knowledge you need to make an informed decision tailored to your unique tax situation.

Winter weather may still be hanging around, but for financially-minded folks, a different kind of chill is in the air – tax season is upon us! While April 15th might feel like a distant date on the horizon, it's approaching rapidly. This begs the question: early-bird filing or a last-minute scramble? There is no magical, one-size-fits-all answer; it all boils down to your unique financial situation and goals.

While many routines in life remain consistent, the tax code isn't one of them. Every year brings adjustments, and 2023 is no exception to that rule. Several vital changes, driven by inflation, have impacted everything from tax brackets to retirement contributions, but don’t fret - some of the changes might even be beneficial. Read through to get a clear breakdown of what's new, and the ways in which it will (or will not) affect your tax status this year. If you need expert tax advice or clarification on any of these adjustments, arrange a meeting with your CPA or other professional tax preparer.

As the end of the year approaches, and the trajectory of our lives seems to speed up towards the holidays, it’s a good idea to take a moment and consider your financial situation. Getting your finances in order before the year ends can provide peace of mind, positioning you for a smooth segue into the new year. Whether you want to pay off debt, save more for retirement, or simply create an updated budget to help achieve your financial goals, now is an ideal time to take action.

The seasons may change, but one thing remains a constant - the inevitability of tax season. Now, as the year winds to a close and the fall leaves have painted the town in shades of amber and gold, it's the perfect time to set the stage for a seamless preparation of next year's tax returns - so start early and you'll find yourself mastering the 2024 tax season.