How well you manage your cash flow is vital to the long-term health of your business. Effective cash management is more than just "money in the bank."

Appropriately used, cash management is the backbone of your operations: it ensures you can pay your staff, purchase your materials, and keep the lights on. It helps you qualify for credit — while keeping that credit available — instead of using it for monthly expenses. Strong cash management practices allow you to be nimble when opportunities arise or stable when the forecast is gloomy. The only way to know if you are in control of your cash is through a thorough cash flow analysis.

What Is a Cash Flow Analysis?

The first step is making sure you do not confuse profit with cash flow. Of course, profit and cash flow intertwine, and both are important to the success of your business. However, despite their close relationship, they serve different functions.

- Profit is the amount of money you keep after subtracting your expenses from sales. But sales are not necessarily the same as cash – if you invoice someone else, it counts as a sale, but you do not yet have cash in hand.

- Cash flow is the amount of money you have available at any given time; it is the relationship between money coming in and money going out.

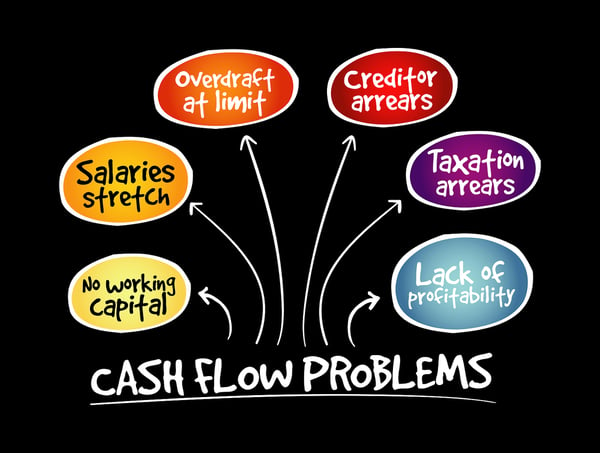

You can be profitable and have poor cash flow, and this is where many businesses get into trouble. Without the cash to meet your obligations, you can get caught in a credit trap until your leverage runs out. Without proper cash flow, you will struggle to keep your business afloat.

A cash flow analysis gives you the full picture of your cash position. By examining the areas where cash moves around, you can expose gaps in payables and receivables and identify weaknesses in credit use or material/inventory costs. A cash flow analysis is only as good as its inputs, which is why it is important to keep your books up to date and organized.

Benefits of Doing a Cash Flow Analysis

Benefits of Doing a Cash Flow Analysis

A cash flow analysis gives you a better picture of your financial health than a profit-and-loss statement or balance sheet does. The major benefits of routine cash flow analysis are:

- You know how much reserve cash to keep on hand to make up for differences between your payables and receivables.

- You maintain consistent inventory by ensuring you can pay your suppliers on time. As a result, your shipments will not be delayed – a scenario that costs you even more money through lost sales or productivity.

- It can put you in a better position when you need financing by demonstrating your ability to pay back loans.

- You can improve your business credit requirements or reevaluate your net terms. Strong creditworthiness requirements reduce defaults, and offering incentives for quick payment minimizes the gaps between your receivables and payables.

Cash flow analysis also provides an opportunity to perform cash flow projections, which provides insight into future cash flows for different time frames. This allows you to smooth out cash flow imbalances by maintaining appropriate cash reserves. It can also be part of future capital investments, expansion planning, or long-term wealth management strategies.

Cash flow analysis can be a daunting task for small businesses. However, it is crucial to your ongoing success and planning. If you are unclear about a cash flow analysis, use the capability of a Certified Professional Accountant. Working with a CPA can show you the big picture through the small details, so things make sense. In addition, a CPA will help you develop a strategy to optimize your cash flow, make proactive financial decisions and develop a solid plan for the future.

Myrick CPA specializes in accounting services for small business start ups and entrepreneurs. If you are a new entrepreneur, contact us. We invite you to learn more about our small business accounting services.