As a taxpayer, you might assume your biggest tax decisions happen in March or April. The truth is, by that point, most of the outcomes are already locked in. Effective tax advisory work happens much earlier and focuses on decisions made during the year which help to shape your end results. Over the next seven weeks, we’ll be exploring more advanced tax reduction strategies, from specialized business deductions to high-income individual tax credits, that help you keep more of what you earn.

If you freelance or work gig jobs, you're probably used to gathering a handful of 1099 forms each spring. That part of tax season isn't going away, but starting in 2026, how those forms get issued will change. The new Federal Tax Bill (OBBBA) updates the reporting rules for businesses that pay freelancers and independent contractors, raising the threshold for when they must issue a Form 1099-NEC or 1099-MISC. Here's what those changes mean, as well as what hasn't changed at all when it comes to reporting your income.

Milestones or life-altering moments have a way of impacting everything, even things you might not expect. A wedding, a divorce, or retirement can reshape your day-to-day life in ways that may feel joyful, difficult, or bittersweet. Along with the emotional impact, there's a practical reality to consider: each and every one of these milestones can change the way you file your taxes. Knowing what to expect and planning ahead helps you avoid costly mistakes and gives you space to focus on the transition itself.

Signed into law on July 4, 2025, the One Big Beautiful Bill Act (OBBBA) brings significant tax changes for individuals, families, and small businesses. Whether you earn wages, run a business, or rely on retirement income, these updates could affect how you plan for the year ahead. Here's what you should know now to prepare for the 2025 tax season and beyond.

The 2024 tax season brings with it a new sense of uncertainty and confusion, which can make it feel even more stressful than usual. Proposed tax law changes from an incoming Presidential administration could include retroactive adjustments, potentially affecting your financial plans for the year. While all of this might seem overwhelming, the right strategies and a proactive approach can help you stay ahead of the curve.

Crowdfunding has become a popular way to raise funds for everything from new business ventures to charitable causes. Platforms like Kickstarter and GoFundMe make it easy to reach a wide audience and gather financial support, but if you’re organizing a crowdfunding campaign, it’s essential to understand the tax obligations that come with those contributions. In some cases, money raised through these platforms may be subject to income tax, requiring careful record keeping and reporting.

Facing tax issues with the IRS can feel overwhelming, especially if you’re dealing with a tax lien or levy. These actions are serious, and understanding what the IRS can and cannot do is critical to protecting your assets and resolving the problem quickly. The good news? With the help of a qualified CPA, you can take steps to address the situation and get back on solid financial ground.

The IRS recently adjusted Health Savings Accounts (HSA) rules for 2025. If you've been using an HSA as part of your financial plan, now is a great time to revisit your strategy to ensure it's still working as well as possible. Understanding these new changes is a vital part of making sure you're maximizing your tax savings and the benefits of your HSA.

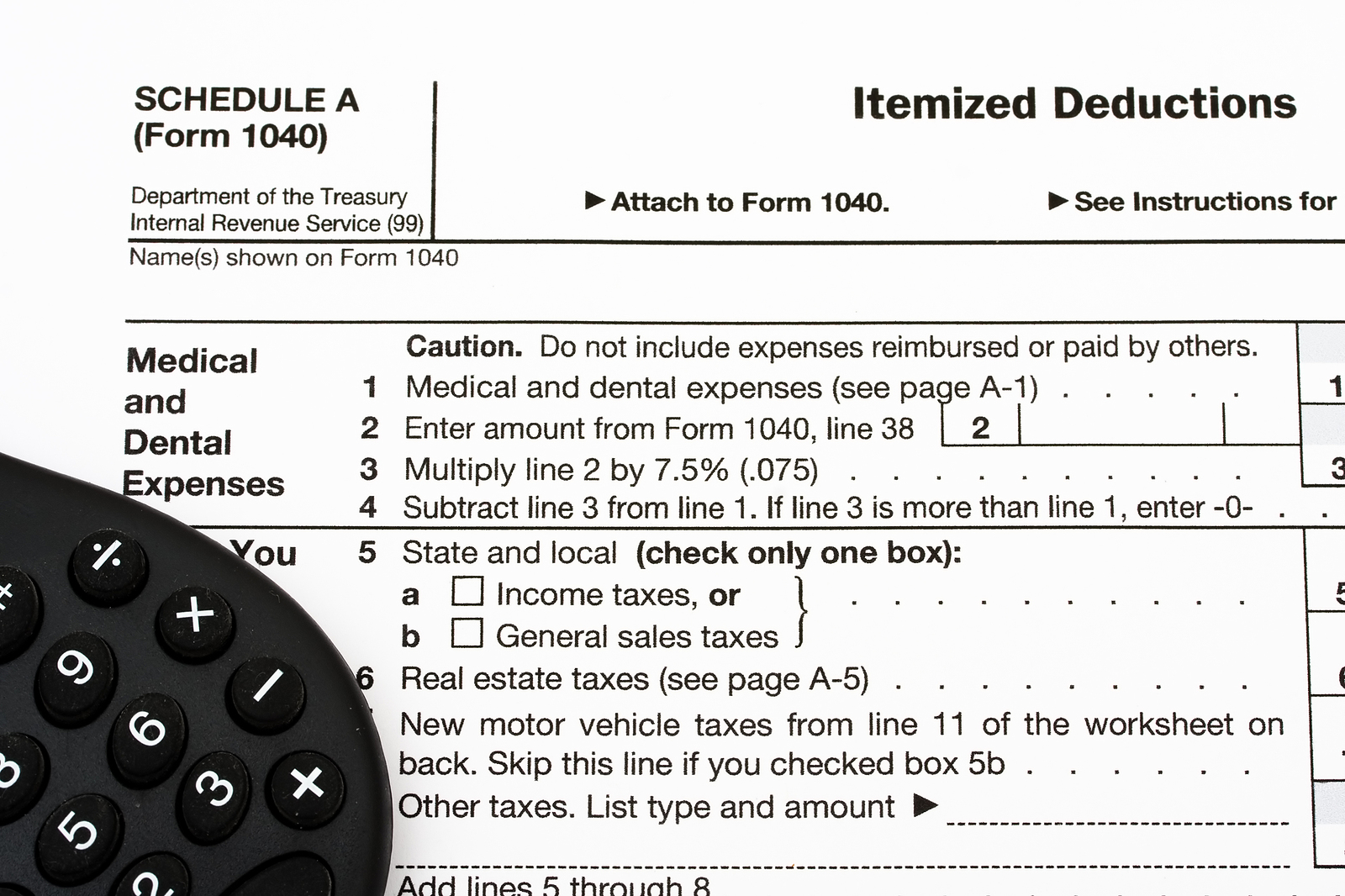

It's tax time again, which often means a flurry of activity, a blizzard of paperwork, and an avalanche of mixed information. Arguably, one of the most important decisions you'll face this tax season is whether to take the standard deduction or itemize your deductions. This seemingly minor decision can have a massive impact on the complexity of your filing process but can still be the best choice in many situations. Explore the world of itemized deductions to equip yourself with the knowledge you need to make an informed decision tailored to your unique tax situation.

Facing an IRS audit or dealing with a complex tax issue can feel a bit like navigating an endless, highly complicated maze. While the IRS does provide resources and information, the process can be incredibly overwhelming, leaving you feeling unsure and out of your depth. In these situations, understanding your options and seeking professional support becomes crucial. This is where third-party representation comes in, offering a valuable solution to individuals and businesses facing tax challenges.