It's tax time again, which often means a flurry of activity, a blizzard of paperwork, and an avalanche of mixed information. Arguably, one of the most important decisions you'll face this tax season is whether to take the standard deduction or itemize your deductions. This seemingly minor decision can have a massive impact on the complexity of your filing process but can still be the best choice in many situations. Explore the world of itemized deductions to equip yourself with the knowledge you need to make an informed decision tailored to your unique tax situation.

Understanding Itemized Deductions

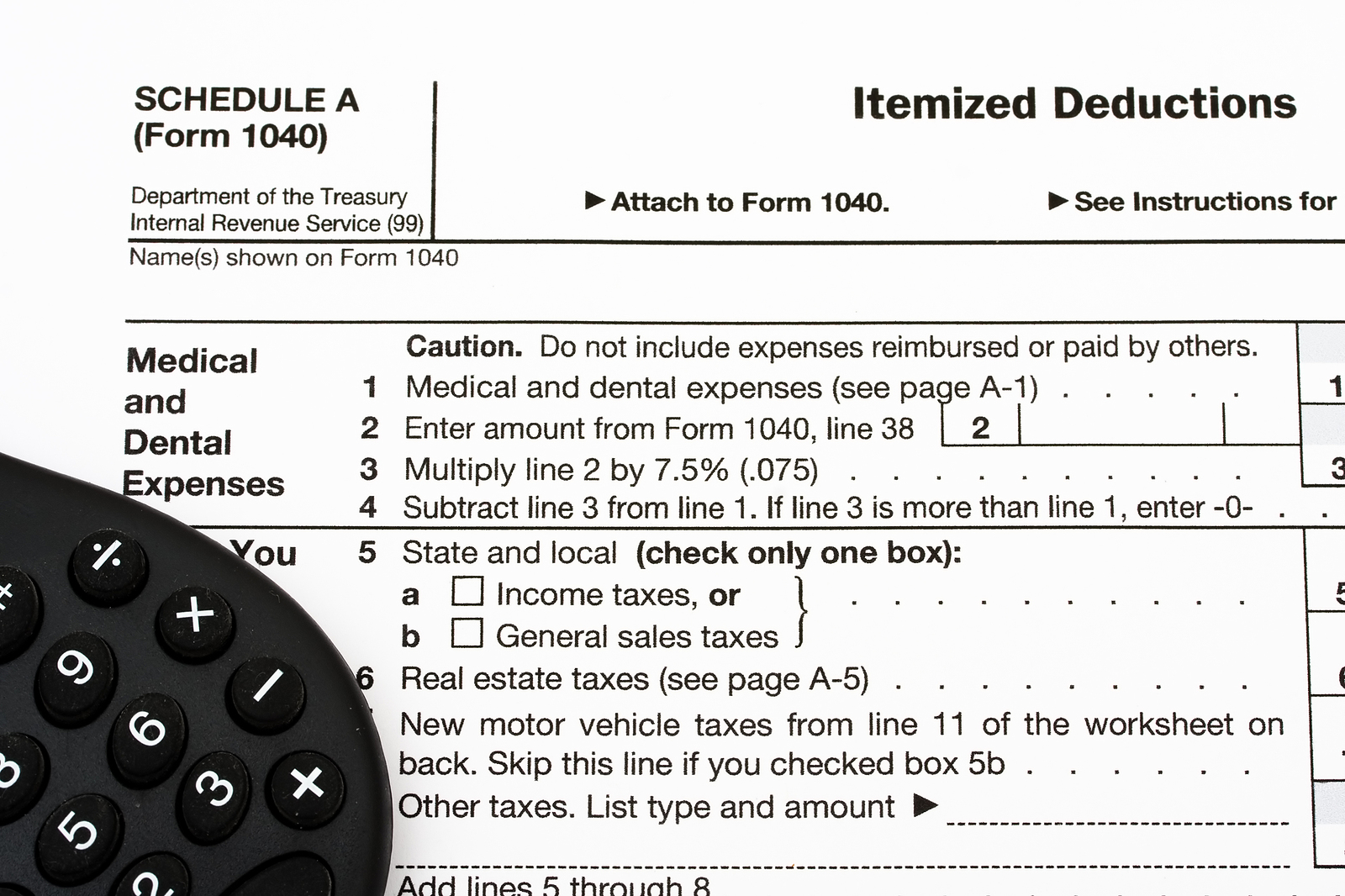

In most cases, you can deduct specific expenses from your taxable income to lower your tax burden. Itemizing these deductions, rather than taking the standard deduction, means listing these expenses on Schedule A of Form 1040. Common itemizable deductions include but aren't limited to:

- Mortgage interest: Interest paid on your primary and secondary home mortgages can be deducted, with limitations.

- State and local income taxes: State and local income taxes or sales taxes you paid can be deducted (limited to a certain amount).

- Charitable donations: Contributions to qualified charitable organizations can be deducted, with limitations based on the type and value of donation.

- Medical and dental expenses: You can potentially deduct medical and dental expenses that exceed 7.5% of your Adjusted Gross Income (AGI).

The Standard Deduction vs. Itemizing Expenses

The IRS offers a standard deduction amount that varies depending on your filing status (single, married, filing jointly, etc.). This standard deduction is a set dollar amount you can deduct from your income, regardless of your actual expenses. The critical question is: will itemizing your deductions result in a greater tax benefit than the standard deduction?

Here are some key factors to consider when deciding whether to itemize:

- Your total itemizable deductions: If the sum of your itemizable deductions (mortgage interest, charitable contributions, etc.) exceeds the standard deduction for your filing status, then itemizing may be beneficial.

- Your income level: Generally, as your income level increases, the standard deduction also increases. This makes itemizing less attractive for high-income earners.

- The types of deductions you have: Due to recent tax law changes, certain deductions, like mortgage interest and state and local taxes, are becoming less common. Analyze your specific situation to see which deductions might benefit you.

While a larger tax refund can be enticing, remember that itemizing doesn't guarantee a bigger tax return. It merely allows you to deduct more expenses if they exceed the standard deduction. Here are some additional factors to consider:

- Complexity: Itemizing requires keeping detailed records of your deductible expenses. This can be time-consuming and requires meticulous organization.

- Audit risk: While the IRS doesn't publicly disclose specific audit rates, it's widely acknowledged that those opting to itemize could find their returns under more rigorous examination. The increased scrutiny is generally attributed to the complexities inherent to itemizing deductions, which creates more opportunities for inaccuracies. The importance of meticulous, highly accurate record-keeping can't be overstated whether you take the standard deduction or itemize, but it's particularly important in this scenario.

Myrick CPA: Your Partner in Smart Tax Strategy

Filing your taxes can be an overwhelming, stressful, and all-around unpleasant experience, but it doesn't have to be. At Myrick CPA, we go beyond just preparing your tax returns; we work hard to help you make the right choices for your unique circumstances. We can:

- Analyze your financial situation and income level.

- Review your potential itemizable deductions and compare them to the standard deduction.

- Explain the potential audit risk associated with itemizing.

- Develop a personalized tax-filing strategy that maximizes your tax benefit while minimizing your stress

When you choose Myrick CPA, you choose a trusted advisor for your tax needs with a track record of experience and tax-strategy success. Contact us to schedule a consultation; don't let tax season be a source of distress. With a partner on your side who understands the nuances of itemized deductions and potential benefits, you can rest assured you're making smart financial moves.