The 2024 tax season brings with it a new sense of uncertainty and confusion, which can make it feel even more stressful than usual. Proposed tax law changes from an incoming Presidential administration could include retroactive adjustments, potentially affecting your financial plans for the year. While all of this might seem overwhelming, the right strategies and a proactive approach can help you stay ahead of the curve.

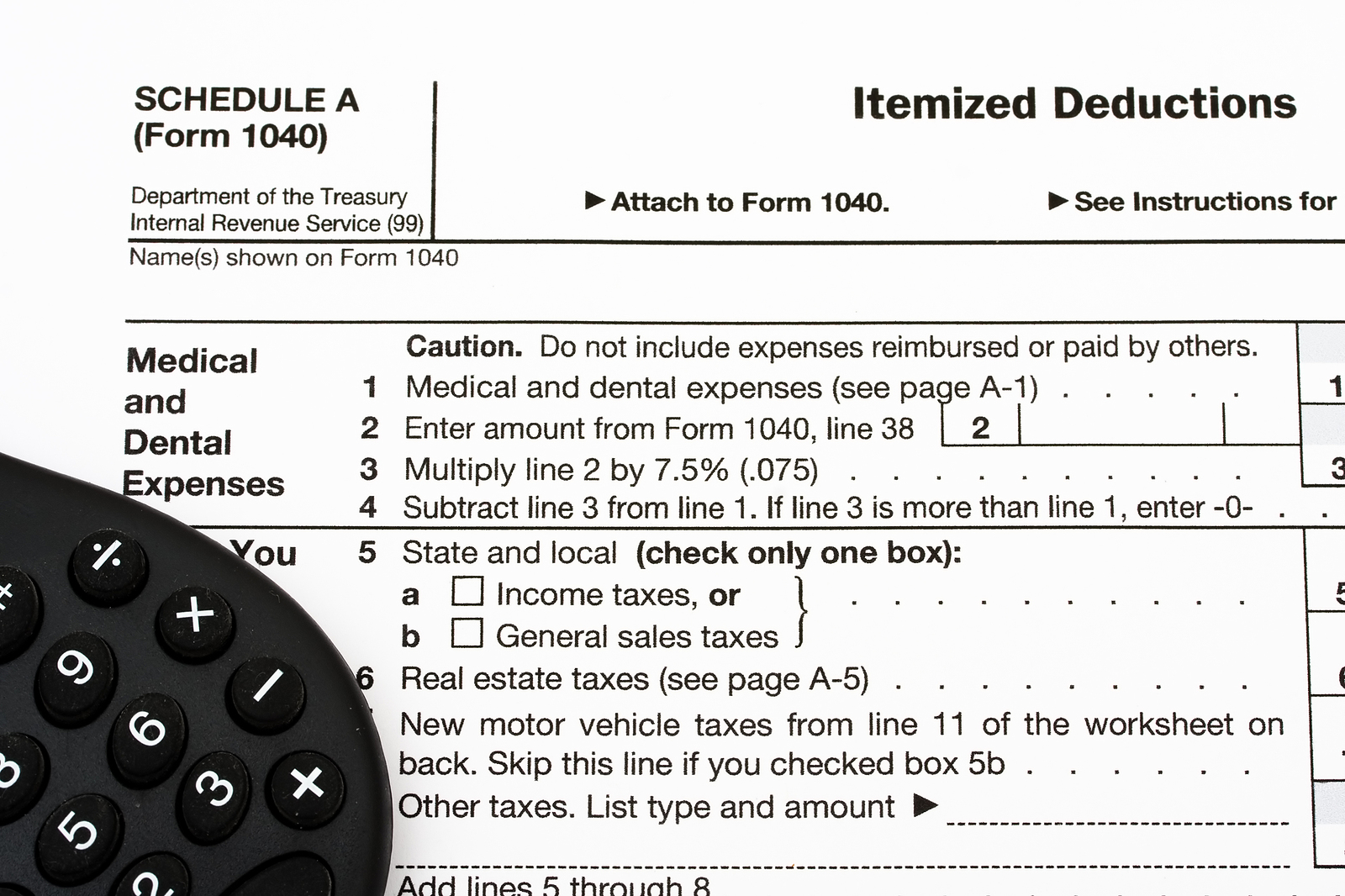

It's tax time again, which often means a flurry of activity, a blizzard of paperwork, and an avalanche of mixed information. Arguably, one of the most important decisions you'll face this tax season is whether to take the standard deduction or itemize your deductions. This seemingly minor decision can have a massive impact on the complexity of your filing process but can still be the best choice in many situations. Explore the world of itemized deductions to equip yourself with the knowledge you need to make an informed decision tailored to your unique tax situation.

Though it’s common knowledge that taxes are one of life's few certainties, taxes can certainly feel complicated and confusing at times. For some filers, tax season is a stressful scramble for receipts, forms, and information. For others, the season brings the welcome news of a tax refund - a nice chunk of change heading back into your pocket when the process concludes for the year. Still, the path your tax refund takes from the time you file to when you actually receive your money can feel like it's shrouded in mystery. What factors affect how long it takes to arrive? And, once it does, what are some of the wisest ways to put your windfall to use?

Winter weather may still be hanging around, but for financially-minded folks, a different kind of chill is in the air – tax season is upon us! While April 15th might feel like a distant date on the horizon, it's approaching rapidly. This begs the question: early-bird filing or a last-minute scramble? There is no magical, one-size-fits-all answer; it all boils down to your unique financial situation and goals.

While many routines in life remain consistent, the tax code isn't one of them. Every year brings adjustments, and 2023 is no exception to that rule. Several vital changes, driven by inflation, have impacted everything from tax brackets to retirement contributions, but don’t fret - some of the changes might even be beneficial. Read through to get a clear breakdown of what's new, and the ways in which it will (or will not) affect your tax status this year. If you need expert tax advice or clarification on any of these adjustments, arrange a meeting with your CPA or other professional tax preparer.

The Inflation Reduction Act (IRA) of 2022 represents a significant milestone in U.S. tax legislation. Designed to address economic concerns and support various sectors of the economy, this legislation brings several key tax benefits to American taxpayers. Delve into the details of this complex yet vital piece of legislation.

It’s no secret that marriage is a life-changing event, often in ways you never expected. One of those oft-overlooked changes is the impact that getting married can have on your taxes. Learn more about the eligibility criteria and explore the best strategies to maximize your savings. Whether you’re newlyweds or are celebrating a milestone anniversary, a better understanding can help you and your spouse make more informed financial decisions. There are a relatively broad range of tax breaks for married couples. Discover the advantages and benefits, all of which have the potential to lead to significant savings.

Investing in education is almost always a wise decision, but it can also introduce a very real financial burden. Fortunately, there are education tax credits that can present a valuable opportunity to offset some of the associated expenses. Exploring how education tax credits work, the eligibility criteria, and how they can benefit you as a taxpayer can make higher education more accessible. Whether you are a student working to further your education, a small business owner taking courses for your own professional development, or the parent of a college student, these credits can lead to substantial tax savings. Here’s how education tax credits offer tax savings for eligible taxpayers.

When tax season approaches, it’s always a good idea for parents and guardians to familiarize themselves with the current rules for claiming dependents. Doing so can lead to valuable tax benefits but also comes with highly specific eligibility criteria and guidelines. Delve into the intricacies of claiming dependents on your income taxes and empower yourself with the knowledge you need to make informed decisions, maximize tax savings, and ensure full compliance with tax regulations. Here’s what you need to know about the tax rules for claiming dependents.

Tax credits are powerful tools that directly reduce your tax liability, dollar for dollar. Unlike deductions designed to reduce your taxable income, tax credits directly reduce the amount of tax you owe. Tax credits are a great way to save money on your taxes because they can help to reduce your overall tax burden or even entitle you to a tax refund. Read on to learn more about the tax credits you don’t want to miss - and how to determine your eligibility.