Most people assume their tax preparer's job is done once their tax return is filed. But what happens if, months or even years later, the IRS sends a notice or requests more information? Not all tax service providers offer long-term support after tax season, which can leave taxpayers scrambling to respond to IRS inquiries on their own. Myrick CPA takes a different approach. Our Tax Service Guarantee provides ongoing protection, ensuring that if the IRS or state tax authorities reach out, you have a trusted professional handling the situation from start to finish.

When most people think about taxes, they picture gathering documents and racing to meet the filing deadline. But there's a lot more to managing taxes than filing once a year. Tax preparation and tax strategy may sound similar, but they serve very different purposes. While one focuses on compliance, the other focuses on building long-term financial benefits.

Let's break down these concepts and explain why working with a trusted CPA can make a significant difference in your financial outlook.

Tax season. It's the time of year when all eyes are on finances, while many eagerly anticipate a tax refund they see as a financial windfall. While everyone loves to have more money show up in their bank account from the IRS, refunds aren't the be-all and end-all when it comes to successful tax planning. Before you put all your eggs in the refund basket, let's explore why owing no tax can be a better, more strategic move that puts you in greater control of your finances.

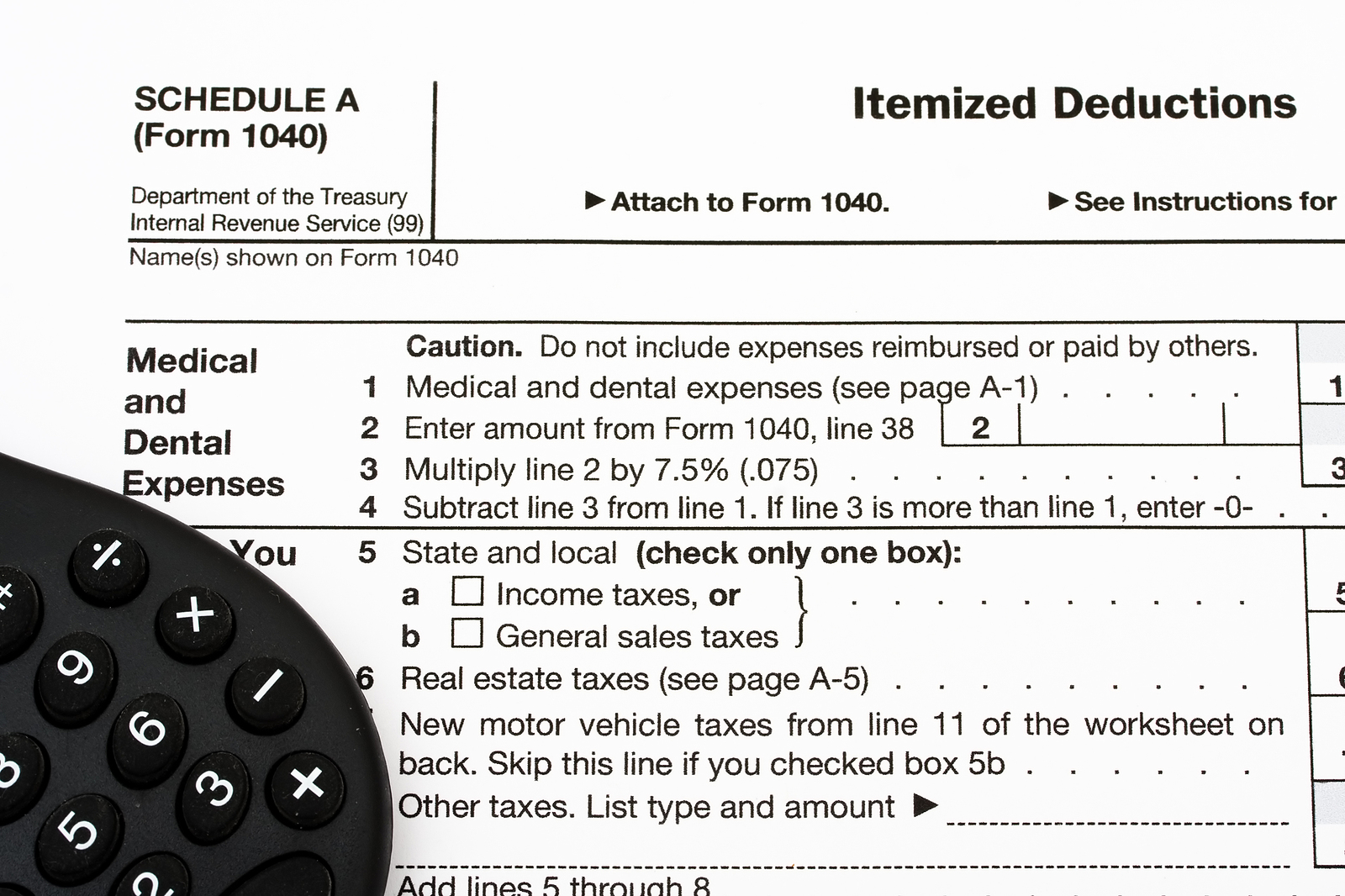

It's tax time again, which often means a flurry of activity, a blizzard of paperwork, and an avalanche of mixed information. Arguably, one of the most important decisions you'll face this tax season is whether to take the standard deduction or itemize your deductions. This seemingly minor decision can have a massive impact on the complexity of your filing process but can still be the best choice in many situations. Explore the world of itemized deductions to equip yourself with the knowledge you need to make an informed decision tailored to your unique tax situation.

Though it’s common knowledge that taxes are one of life's few certainties, taxes can certainly feel complicated and confusing at times. For some filers, tax season is a stressful scramble for receipts, forms, and information. For others, the season brings the welcome news of a tax refund - a nice chunk of change heading back into your pocket when the process concludes for the year. Still, the path your tax refund takes from the time you file to when you actually receive your money can feel like it's shrouded in mystery. What factors affect how long it takes to arrive? And, once it does, what are some of the wisest ways to put your windfall to use?