The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, introduced several new tax provisions that affect both individuals and businesses. Among the most significant for retirees is a brand-new deduction aimed at seniors. Starting with the 2025 tax year, taxpayers age 65 and older may qualify for an additional deduction of up to $6,000 for single filers or $12,000 for married couples filing jointly if both spouses meet the age requirement.

Milestones or life-altering moments have a way of impacting everything, even things you might not expect. A wedding, a divorce, or retirement can reshape your day-to-day life in ways that may feel joyful, difficult, or bittersweet. Along with the emotional impact, there's a practical reality to consider: each and every one of these milestones can change the way you file your taxes. Knowing what to expect and planning ahead helps you avoid costly mistakes and gives you space to focus on the transition itself.

Signed into law on July 4, 2025, the One Big Beautiful Bill Act (OBBBA) brings significant tax changes for individuals, families, and small businesses. Whether you earn wages, run a business, or rely on retirement income, these updates could affect how you plan for the year ahead. Here's what you should know now to prepare for the 2025 tax season and beyond.

Lots of people only think about taxes once a year, typically around the April deadline. But keeping up with your tax situation throughout the year can save you money and help you avoid surprises. You don't have to own a business or have a complex financial life to benefit from it. Anyone who wants to feel more in control should consider a year-round approach. At Myrick CPA, we help our clients plan ahead so tax season doesn't catch them off guard. Here are a few steps you can take now to make filing easier later.

The 2024 tax season brings with it a new sense of uncertainty and confusion, which can make it feel even more stressful than usual. Proposed tax law changes from an incoming Presidential administration could include retroactive adjustments, potentially affecting your financial plans for the year. While all of this might seem overwhelming, the right strategies and a proactive approach can help you stay ahead of the curve.

When most people think about taxes, they picture gathering documents and racing to meet the filing deadline. But there's a lot more to managing taxes than filing once a year. Tax preparation and tax strategy may sound similar, but they serve very different purposes. While one focuses on compliance, the other focuses on building long-term financial benefits.

Let's break down these concepts and explain why working with a trusted CPA can make a significant difference in your financial outlook.

As the end of the year approaches, it’s easy to get caught up in the holiday rush. Still, setting aside a little time to organize your tax documents now to get ahead of the time crunch can save you stress heading into the new year.

Here are some simple ways to get your documents in order and tips on setting up your tax planning meeting.

Owning your home means assuming many responsibilities, but it also brings a host of potential tax benefits to the table. As a homeowner in Washington, D.C., or the surrounding area, you could be eligible for multiple tax deductions and housing programs designed to help reduce your tax burden. The key to reaping all those benefits is understanding which home-related expenses are deductible and which ones aren't.

As tax season begins to wind down, you're likely breathing a sigh of relief, with your financial documents and receipts soon to be stowed away until next year. Before you tuck those files away, consider this: the very best time to craft your tax savings plan is actually right now.

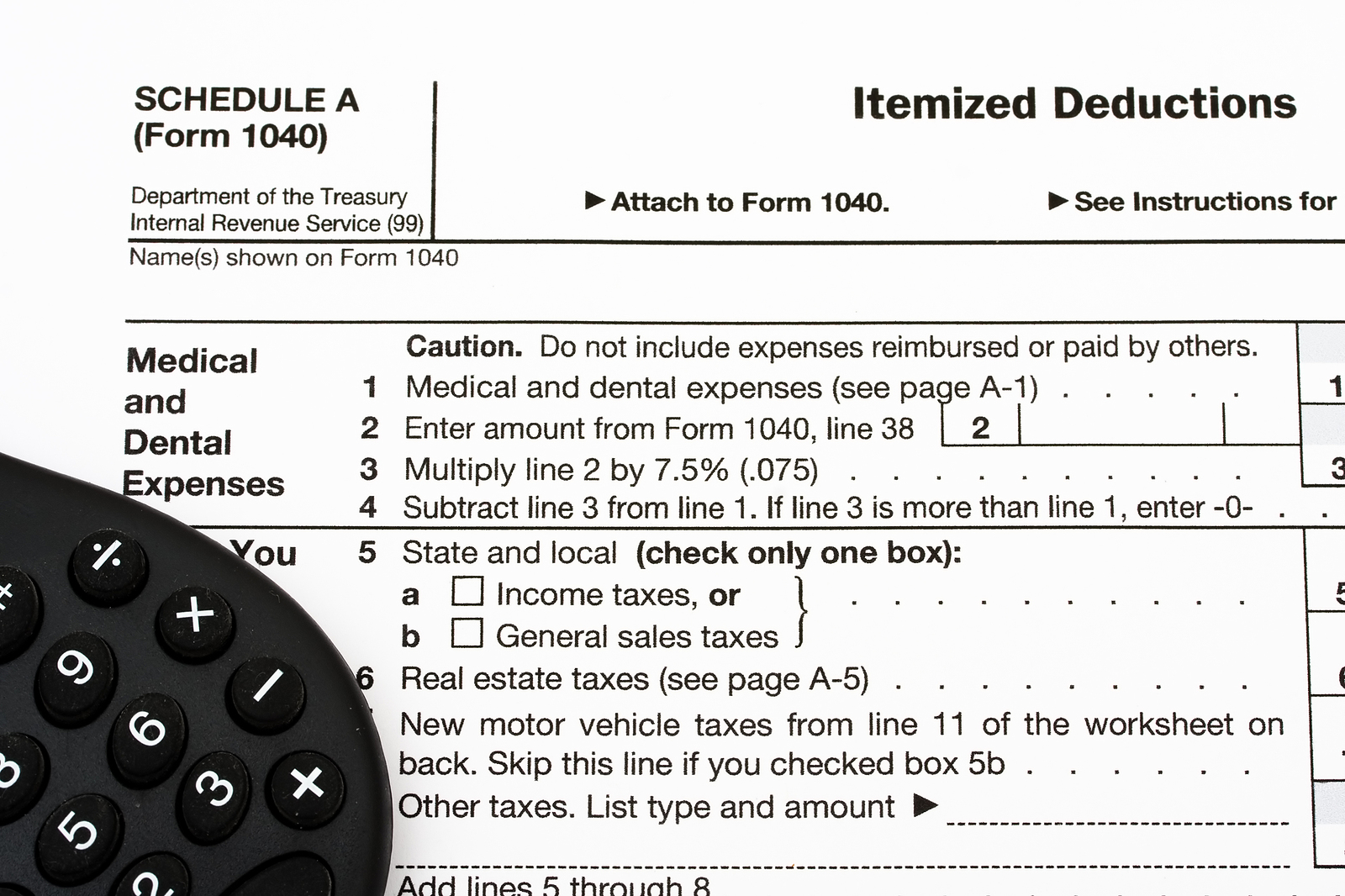

It's tax time again, which often means a flurry of activity, a blizzard of paperwork, and an avalanche of mixed information. Arguably, one of the most important decisions you'll face this tax season is whether to take the standard deduction or itemize your deductions. This seemingly minor decision can have a massive impact on the complexity of your filing process but can still be the best choice in many situations. Explore the world of itemized deductions to equip yourself with the knowledge you need to make an informed decision tailored to your unique tax situation.