The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, introduced several new tax provisions that affect both individuals and businesses. Among the most significant for retirees is a brand-new deduction aimed at seniors. Starting with the 2025 tax year, taxpayers age 65 and older may qualify for an additional deduction of up to $6,000 for single filers or $12,000 for married couples filing jointly if both spouses meet the age requirement.

Most people assume their tax preparer's job is done once their tax return is filed. But what happens if, months or even years later, the IRS sends a notice or requests more information? Not all tax service providers offer long-term support after tax season, which can leave taxpayers scrambling to respond to IRS inquiries on their own. Myrick CPA takes a different approach. Our Tax Service Guarantee provides ongoing protection, ensuring that if the IRS or state tax authorities reach out, you have a trusted professional handling the situation from start to finish.

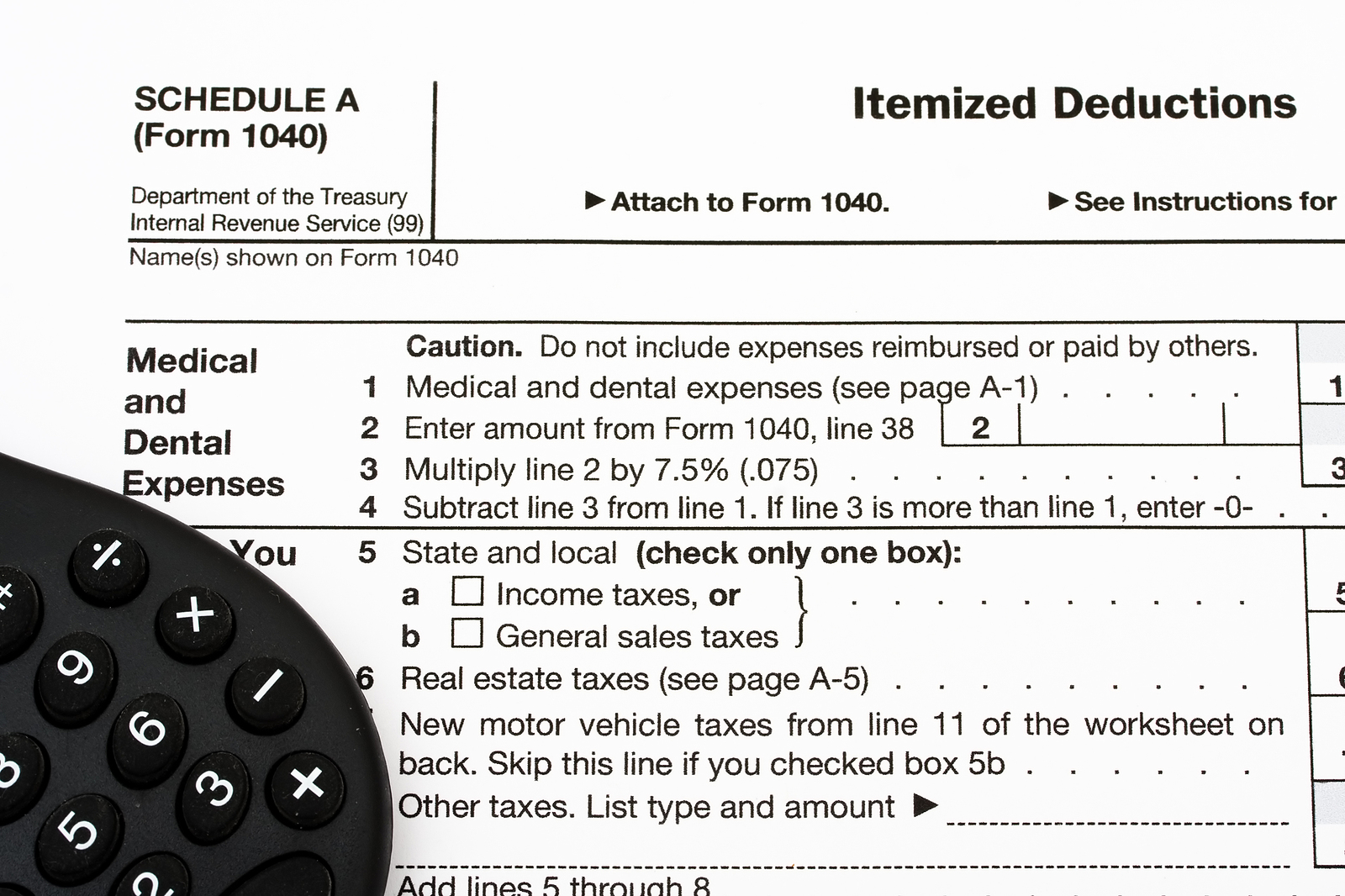

It's tax time again, which often means a flurry of activity, a blizzard of paperwork, and an avalanche of mixed information. Arguably, one of the most important decisions you'll face this tax season is whether to take the standard deduction or itemize your deductions. This seemingly minor decision can have a massive impact on the complexity of your filing process but can still be the best choice in many situations. Explore the world of itemized deductions to equip yourself with the knowledge you need to make an informed decision tailored to your unique tax situation.