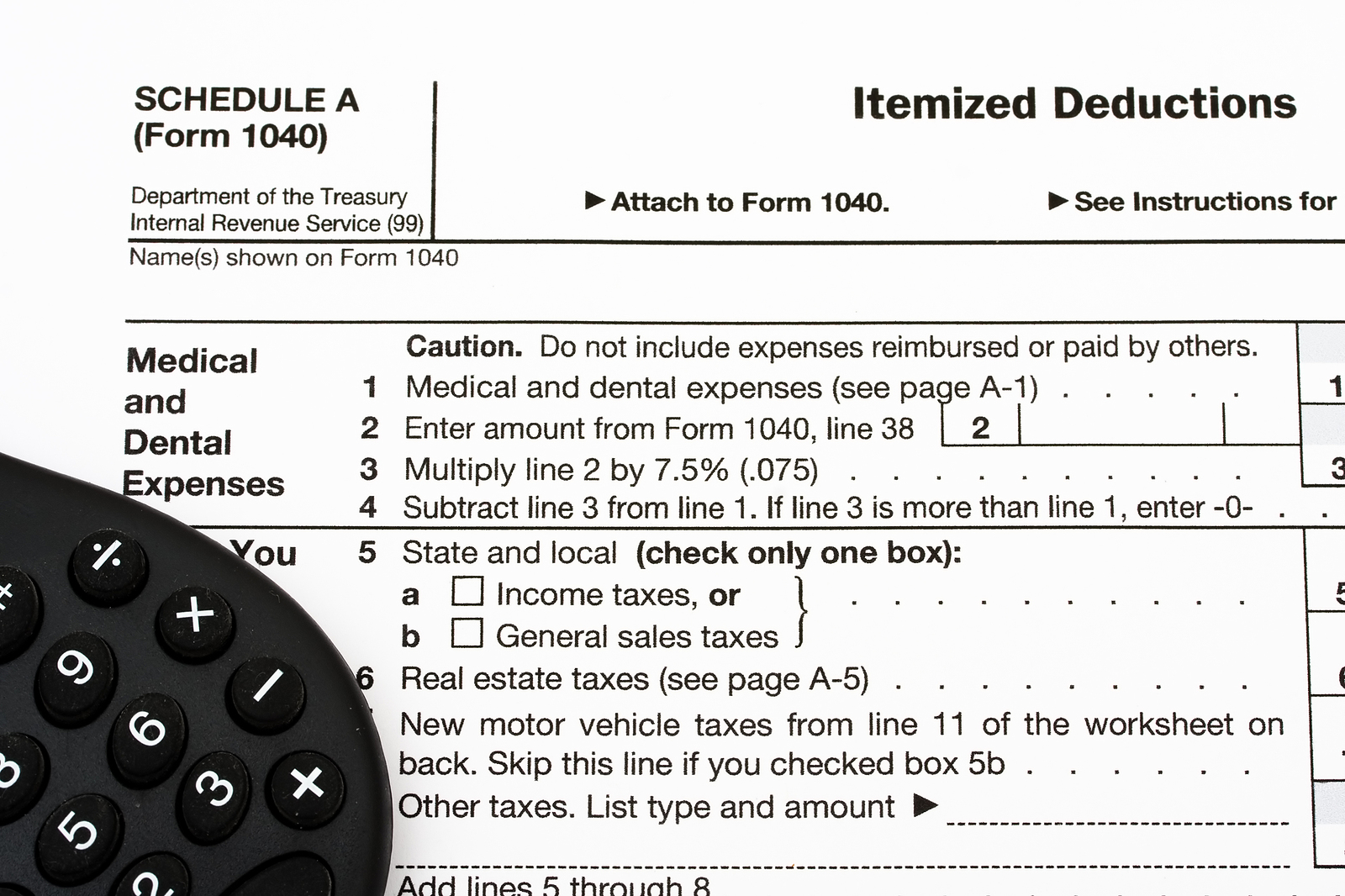

As the end of the year approaches, it’s easy to get caught up in the holiday rush. Still, setting aside a little time to organize your tax documents now to get ahead of the time crunch can save you stress heading into the new year.

Here are some simple ways to get your documents in order and tips on setting up your tax planning meeting.