For many individual taxpayers and small business owners working to navigate the ever-shifting financial landscape, the term "capital gains" looms like a shadow. Fear not, though; unmasking this particular beast is simpler than you might think. Learn how to solve the mysteries of capital gains taxes, explore calculation methods, and uncover strategies to potentially minimize their bite.

Posted by: Myrick CPA

Posted on: Jan 04 2024

Posted by: Charles P Myrick CPA

Posted on: Nov 09 2021

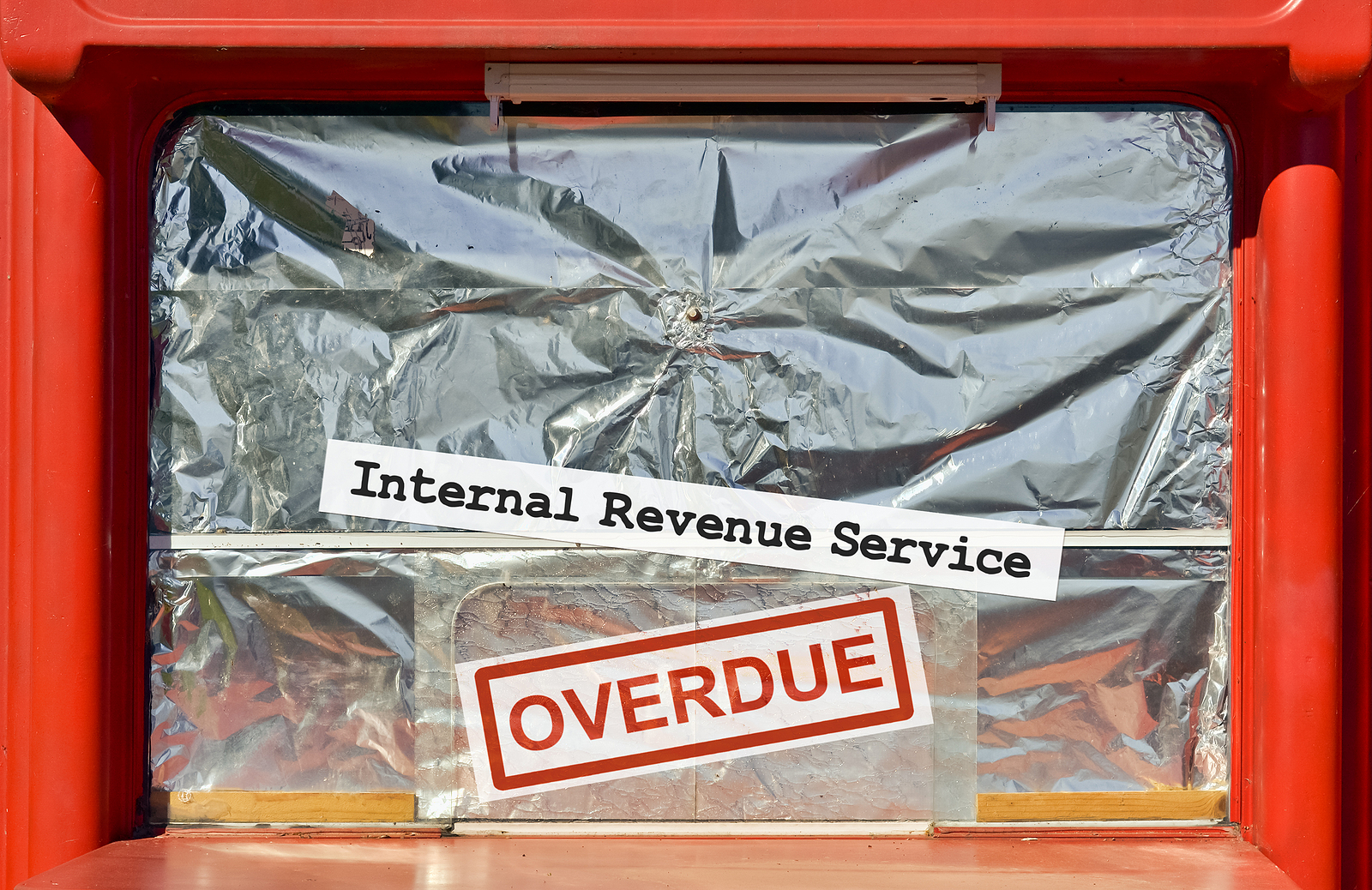

As soon as the IRS contacts you about unpaid taxes, acting quickly can save you a lot of money and help avoid tax liens and levies. Unfortunately, life issues can get in the way of handling back taxes promptly. For example, suppose you haven’t acted upon notification from the IRS regarding unpaid tax liabilities. In that case, you should expect to receive notification from them placing a lien or a levy on your assets. When that happens, you have no time to lose. You must act immediately to prevent that escalation by the IRS because the financial ramifications of either action can be devastating.